All Categories

Featured

Table of Contents

For instance, if the property owner pays the passion and penalties early, this will certainly reduce your return on the investment. And if the home owner states personal bankruptcy, the tax lien certificate will certainly be subservient to the home mortgage and federal back taxes that are due, if any type of. An additional risk is that the worth of the property might be less than the amount of back taxes owed, in which case the house owner will have little motivation to pay them.

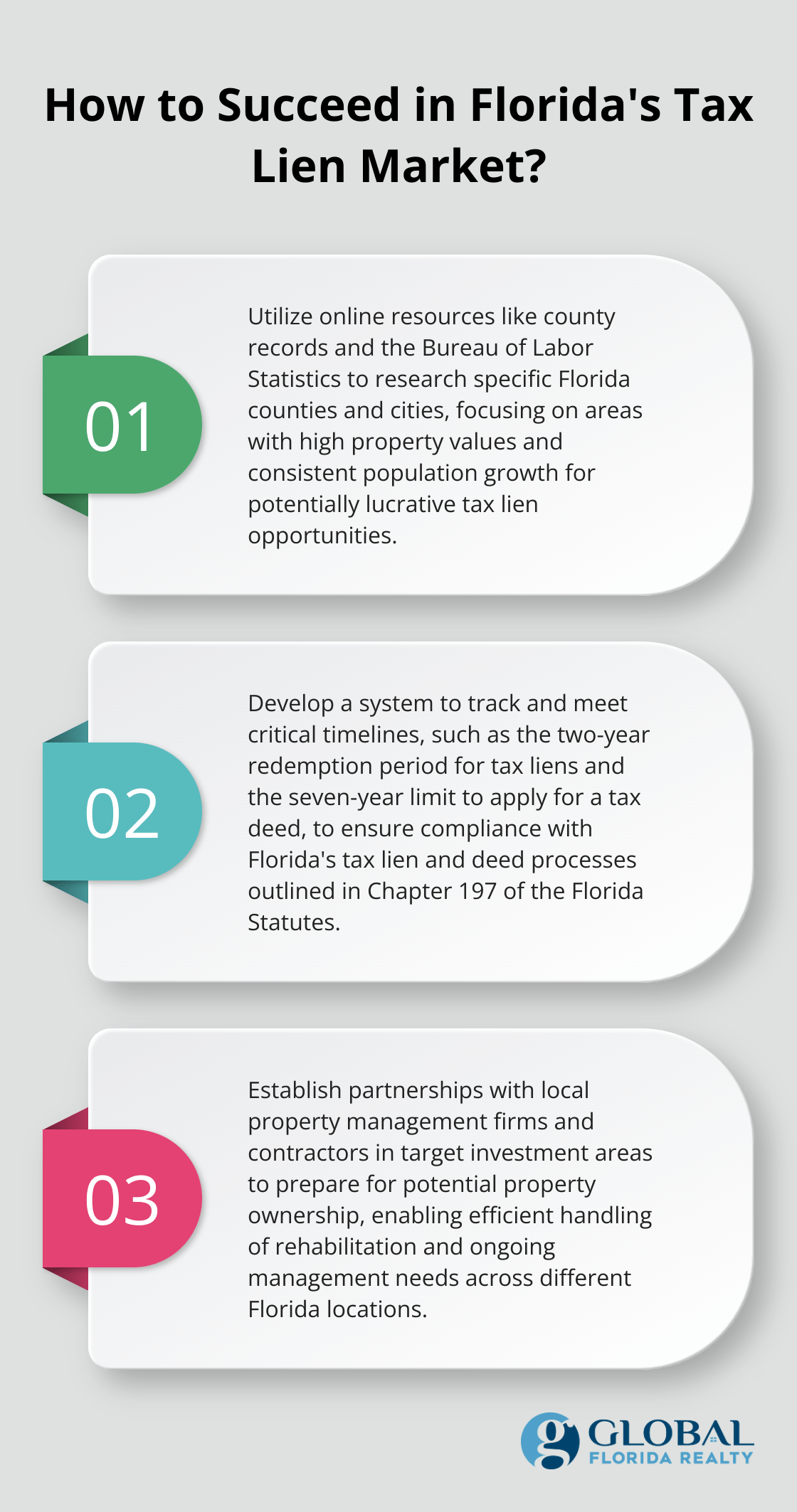

Tax obligation lien certifications are generally marketed through public auctions (either online or in individual) performed every year by area or municipal taxing authorities. Available tax liens are commonly released a number of weeks before the public auction, together with minimum proposal quantities. Inspect the web sites of areas where you want buying tax liens or call the region recorder's office for a listing of tax obligation lien certifications to be auctioned.

Investing In Real Estate Tax Lien

Maintain in mind that most tax obligation liens have an expiry day after which time your lienholder legal rights run out, so you'll need to move rapidly to boost your opportunities of maximizing your investment return. tax lien investing for dummies. Tax lien investing can be a successful way to buy property, however success requires comprehensive research and due diligence

Firstrust has greater than a years of experience in giving financing for tax lien investing, together with a dedicated team of qualified tax lien specialists that can aid you utilize prospective tax obligation lien investing opportunities. Please call us to find out more regarding tax obligation lien investing. FEET - 643 - 20230118.

The tax obligation lien sale is the last action in the treasurer's efforts to gather tax obligations on genuine building. A tax obligation lien is positioned on every county residential or commercial property owing tax obligations on January 1 each year and stays until the real estate tax are paid. If the homeowner does not pay the real estate tax by late October, the region sells the tax lien at the yearly tax lien sale.

The investor that holds the lien will certainly be alerted every August of any type of unpaid taxes and can endorse those tax obligations to their existing lien. The tax obligation lien sale permits straining authorities to obtain their allocated earnings without needing to await overdue taxes to be accumulated. It also supplies an investment opportunity for the general public, participants of which can acquire tax obligation lien certifications that can potentially make an attractive rates of interest.

When redeeming a tax obligation lien, the building proprietor pays the the overdue tax obligations along with the overdue passion that has actually built up against the lien since it was cost tax sale, this is credited to the tax lien holder. Please contact the Jefferson Region Treasurer 303-271-8330 to get payoff details.

Tax Lien Investing 101

Property ends up being tax-defaulted land if the building taxes continue to be unsettled at 12:01 a.m. on July 1st. Residential property that has actually come to be tax-defaulted after 5 years (or 3 years when it comes to residential or commercial property that is likewise based on a hassle reduction lien) becomes subject to the county tax collection agency's power to market in order to satisfy the defaulted real estate tax.

The area tax collector may provide the home for sale at public auction, a secured bid sale, or a discussed sale to a public agency or qualified not-for-profit company. Public auctions are one of the most typical way of selling tax-defaulted property. The public auction is conducted by the area tax obligation collection agency, and the residential property is marketed to the highest prospective buyer.

Key Takeaways Navigating the globe of realty financial investment can be complicated, however understanding various investment opportunities, like, is well worth the job. If you're seeking to expand your portfolio, purchasing tax liens could be a choice worth checking out. This guide is developed to aid you comprehend the fundamentals of the tax lien investment technique, assisting you through its process and aiding you make informed decisions.

A tax obligation lien is a lawful insurance claim imposed by a government entity on a property when the owner falls short to pay real estate tax. It's a way for the government to ensure that it accumulates the needed tax obligation income. Tax liens are connected to the home, not the individual, meaning the lien stays with the home regardless of ownership adjustments until the debt is gotten rid of.

Texas Tax Lien Investing

] Tax lien investing is a kind of realty investment that entails purchasing these liens from the federal government. When you buy a tax obligation lien, you're basically paying somebody else's tax obligation debt. In return, you gain the right to collect the debt, plus interest, from the residential property owner. If the owner fails to pay within a given period, you may also have the chance to seize on the residential property.

As a financier, you can purchase these liens, paying the owed tax obligations. In return, you receive the right to gather the tax obligation financial obligation plus passion from the home owner.

It's important to very carefully weigh these prior to diving in. Tax lien certificate spending deals a much lower resources need when compared to other forms of investingit's feasible to jump right into this possession class for as low as a pair hundred bucks. Among the most substantial draws of tax obligation lien investing is the capacity for high returns.

Sometimes, if the homeowner stops working to pay the tax financial debt, the capitalist might have the opportunity to seize on the residential or commercial property. This can potentially result in obtaining a residential property at a portion of its market price. A tax obligation lien frequently takes top priority over other liens or home mortgages.

This is because, as the preliminary lien owner, you will be needed to acquire any kind of succeeding liens. (New tax obligation liens take priority over old liens; unfortunate however real.) Tax obligation lien investing involves browsing legal treatments, specifically if repossession ends up being essential. This can be difficult and may require legal aid. Redemption Periods: Homeowner generally have a redemption duration throughout which they can settle the tax obligation debt and rate of interest.

Affordable Public auctions: Tax obligation lien auctions can be very competitive, especially for residential or commercial properties in preferable areas. This competition can drive up rates and possibly minimize overall returns.

How To Start Tax Lien Investing

While these processes are not complicated, they can be surprising to brand-new capitalists. If you are interested in obtaining started, review the adhering to steps to purchasing tax liens: Start by informing yourself regarding tax obligation liens and exactly how actual estate auctions function. Understanding the legal and economic ins and outs of tax lien investing is important for success.

Table of Contents

Latest Posts

State Tax Auctions

How To Buy Delinquent Property

Free Tax Lien Sales List

More

Latest Posts

State Tax Auctions

How To Buy Delinquent Property

Free Tax Lien Sales List